Why it matters: TSMC and several other foundries may be hiking prices for their wafers amid unprecedented demand for advanced chips, partly fueled by the pandemic as well as a rapid digital transformation in many organizations. In the case of 5 nm, that's almost exclusively Apple at this point with A14 and M1 SoCs, as well as Intel Xe GPUs. On the 7 nm spectrum, we have AMD, Qualcomm, MediaTek, and Bitmain.

TSMC is currently responsible for about half of the industry's EUV equipment installation base and wafer production, and is slowly gaining more ground as other chip makers struggle to keep up in the adoption of ever more advanced lithography processes.

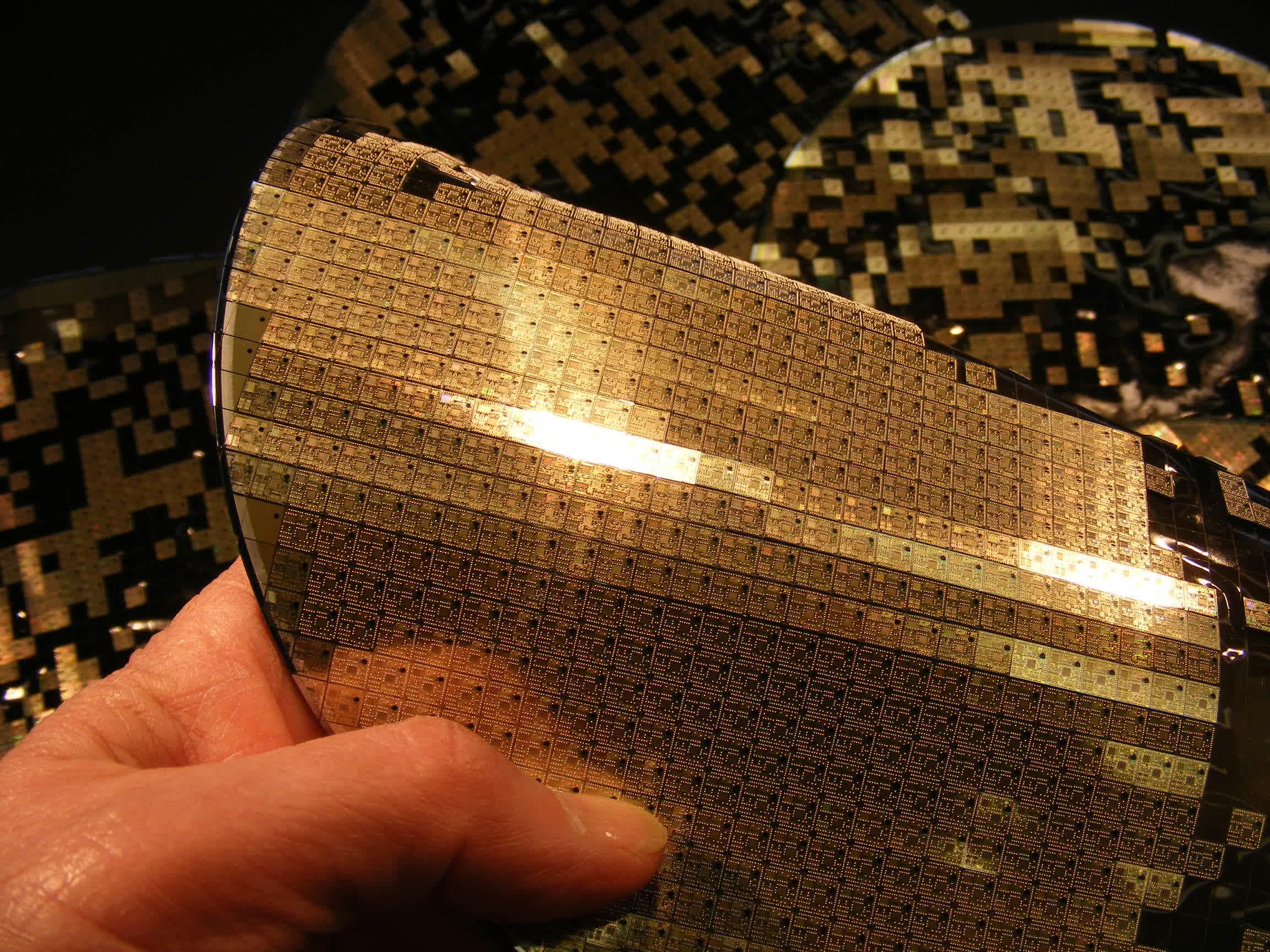

It's also no secret that a single 300 mm wafer built on the newest 7 nm and 5 nm process nodes costs anywhere from $9,000 to $17,000. It turns out that demand for 12-inch wafers is so high that TSMC has reportedly decided to cut discounts and even increase prices for its clients starting in January 2021.

The news come hot on the heels of a report that United Microelectronics Corp, the world's third largest foundry after TSMC and GlobalFoundries, recently hiked its prices for 8-inch wafers for power management chips. And GlobalFoundries is in the middle of a restructuring, which means a slightly lower output while that is ongoing.

In the case of AMD, that could be a big problem as demand is expected to remain high for a number of its products such as Ryzen 5000 CPUs, Radeon 6000 series graphics cards, and SoCs for gaming consoles powered by AMD which includes the PlayStation 5, Xbox Series X, and Xbox Series S.

Analysts expect TSMC to generate around $12.7 billion in revenue in the fourth quarter of this year, which would mark a new record and a 21 percent year-over-year increase.