Maybank Introduces Kill Switch Feature for Credit and Charge Cards

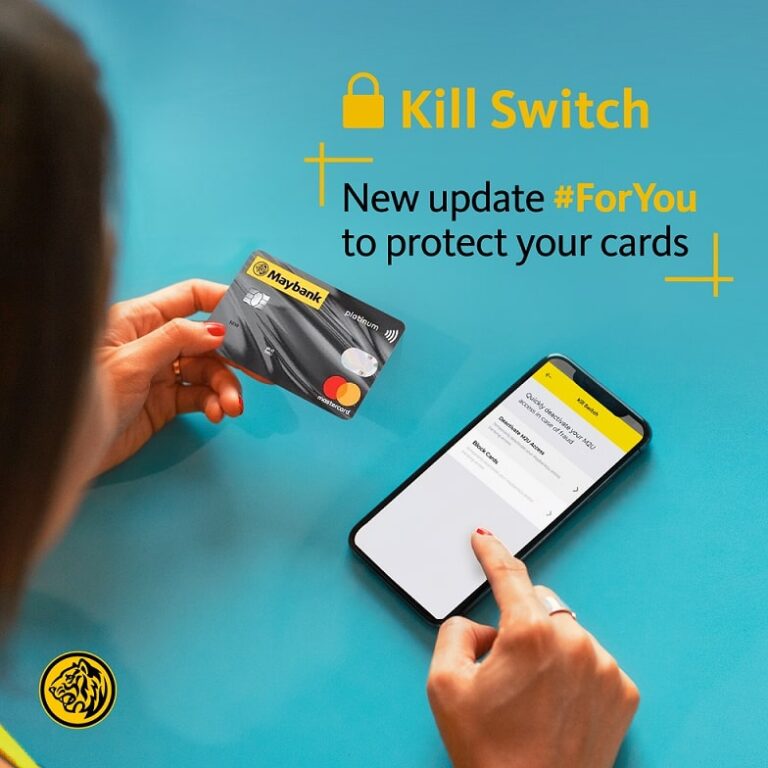

Maybank has extended its kill switch feature to credit and charge cards, allowing you to quickly turn them off if you suspect they have been compromised. Read on to learn more about this new feature and how to access it.

Maybank Introduces Kill Switch for Credit and Charge Cards

Maybank has extended its kill switch feature to credit cards and charge cards, allowing customers to deactivate them quickly if they suspect that they have been compromised. The feature was initially introduced for Maybank2u platform, but the bank has expanded it to cover other cards as well.

The process of accessing the kill switch feature for credit and charge cards is similar to that for Maybank2u. Customers can access it from the same menu in the MAE app, by going to the Maybank2u tab and tapping on the three dots or selecting Kill Switch from the More tab. The kill switch is located under security settings on the website. Customers will be asked to provide their password, even after signing in, before they can deactivate their cards.

When a Maybank card is killed, it cannot be used until reactivated. This is particularly useful in cases where a customer’s card has been used without their knowledge. However, reactivating the card will require customers to visit a Maybank outlet or call the customer care line and verify their identity.

It’s important to note that the kill switch feature is only available for credit cards and charge cards, and not for ATM and debit cards. If an ATM or debit card is compromised, customers will have to deactivate them through the traditional method.

Maybank is the latest bank to introduce a kill switch feature for its cards, which is becoming increasingly important in today’s digital age. With cybercrime on the rise, this feature gives customers a quick and easy way to protect their cards from unauthorized use.

Pokdepinion: In the event than something unfortunate happens, it’s good to have. The faster you can deny access, the better, as you never know how many transactions and headaches could happen within the time it takes to go to the bank to get the cards cancelled off.